If you are looking for BCOC-133 IGNOU Solved Assignment solution for the subject Business Law, you have come to the right place. BCOC-133 solution on this page applies to 2022-23 session students studying in BCOMG, BAVMSME courses of IGNOU.

BCOC-133 Solved Assignment Solution by Gyaniversity

Assignment Code: BCOC-133/TMA/2022-23

Course Code: BCOC-133

Assignment Name: Business Law

Year: 2022-2023

Verification Status: Verified by Professor

Section – A

1) Explain briefly the law relating to communication of offer, acceptance and revocation. Is there any limit of time after which an offer cannot be revoked? (10)

Ans) The law relating to communication of offer, acceptance, and revocation is a crucial part of contract law. These legal principles govern the process by which parties enter into binding agreements and determine the rights and obligations of each party.

An offer is a proposal made by one party to another with the intention of creating a legally binding agreement. It can be made in a variety of ways, such as through written or oral communication, conduct, or even through advertisements or price lists. The offer must be clear and definite, and the terms must be certain and capable of acceptance.

Once an offer is made, it must be communicated to the person to whom it is being made. The communication of the offer is important because it enables the offeree to understand the terms of the offer and decide whether to accept or reject it. If an offer is not communicated, it cannot be accepted, and no contract is formed.

Acceptance is the unqualified and unconditional acceptance of the terms of the offer. It is the expression of assent by the offeree to the terms of the offer, and once accepted, it creates a binding contract between the parties. Acceptance must be communicated to the person who made the offer, and it must be in accordance with the terms of the offer.

In order for an acceptance to be effective, it must be a mirror image of the offer. This means that it must accept all the terms of the offer without modification. If the offeree proposes any changes to the terms of the offer, it is not considered an acceptance but rather a counteroffer. A counteroffer has the effect of rejecting the original offer, and the parties must then negotiate and agree on the new terms of the contract.

Revocation is the act of withdrawing an offer before it is accepted. An offer can be revoked at any time before it is accepted unless the offeror has promised to keep the offer open for a certain period of time or until a certain event occurs. Once an offer has been accepted, it cannot be revoked unless the parties agree to do so.

The communication of revocation is important, and it must be communicated to the offeree before the acceptance is communicated. If the offer is revoked before acceptance, no contract is formed, and the offeree cannot accept the offer.

In terms of the limit of time after which an offer cannot be revoked, it depends on the specific circumstances of the case. If the offeror has promised to keep the offer open for a certain period of time or until a certain event occurs, then the offer cannot be revoked during that period or until that event occurs. This is known as an option contract. An option contract is a contract in which the offeror promises to keep the offer open for a certain period of time, and the offeree pays consideration for that promise. If no such promise has been made, the offer can be revoked at any time before it is accepted.

2) “Insufficiency of consideration is immaterial, but a valid contract must be supported by lawful and real consideration.” Comment. (10)

Ans) Consideration is a fundamental concept in contract law. It refers to the benefit that each party receives in exchange for their promise or performance under the contract. A contract without consideration is not legally binding, and thus the concept of consideration is essential to the enforceability of contracts. Under the law, consideration must be both real and lawful. Real consideration means that there must be a genuine exchange of value between the parties. In other words, each party must receive something of value in exchange for their promise or performance. The value given and received by each party need not be equal, but there must be some value exchanged.

On the other hand, lawful consideration means that the consideration given must not be illegal, against public policy or immoral. A promise that is illegal, such as a contract to commit a crime, is not enforceable even if there is consideration. Similarly, a contract that is against public policy, such as a contract to bribe a public official, is not enforceable, even if there is consideration. However, the law does not require that the consideration be adequate or proportionate to the value of the promise or performance. This means that the parties to a contract are free to negotiate the terms of the agreement and determine what consideration is sufficient to support their promises. Insufficiency of consideration, in other words, is immaterial, so long as there is some real and lawful consideration exchanged.

For example, if A agrees to sell his car to B for one dollar, the consideration given by B may be inadequate or disproportionate to the value of the car. However, since there is some real and lawful consideration given, namely the one dollar, the contract is valid and enforceable.

Furthermore, the consideration must be bargained for, meaning that it must be given in exchange for the promise or performance. It cannot be a gift or past consideration. Past consideration refers to something that has already been given or performed before the contract was made, and thus cannot support a promise or performance made in the future.

For instance, if A promises to pay B for a service that B had already provided to A, the consideration is past, and the promise is unenforceable. However, if A had promised to pay B for the service before the service was provided, then the consideration is bargained for and enforceable.

In summary, consideration is an essential component in the law of contracts, and in order for a contract to be enforceable, it must be supported by consideration that is both real and legal. It makes no difference if the amount of consideration that is given is insufficient as long as it is legitimate and within the bounds of the law. On the other hand, the consideration can't be a gift or anything that was taken into consideration in the past. It is essential for the parties to a contract to have a solid grasp of the idea of consideration and to take steps to guarantee that they have adequately exchanged sufficient consideration to back up any promises or performances they make.

3) Enumerate the different types of partners and briefly explain the extent of their liabilities. (10)

Ans) The different types of partners and extent of their liabilities are as follows:

Active or Ostensible Partner: "Active" or "ostensible" partner refers to a person who signs a contract to become a partner and takes an active role in running the business. For all business actions taken in the normal course of business, he acts as a representative of the other partners. This means that he can bind himself and the other partners to third parties for all business actions taken in the firm's name and in the normal course of business. If he retires, he must tell the public so that he isn't responsible for what other partners do after he leaves.

Sleeping or Dormant Partner: Someone who invests their own money in a business in exchange for a share of the earnings is known as a "sleeping partner." However, he does not participate in the management of the company. Even if outside parties might not be aware that he is a partner in the company, he bears the same level of responsibility for the obligations of the business as an undisclosed principal. However, he is under no need to inform anyone of his decision to withdraw from the partnership.

Nominal Partner: A partner is said to be a "nominal partner" if that partner does not provide any funds to the firm, does not receive a share of the earnings, and does not assist in the management of the business. This type of partner is more concerned with lending his name to the company rather than actively participating in its operations. However, he and the other partners are accountable for all of the company's financial obligations to any third party that conducts business with the company.

Partner in Profits Only: A person is referred to as a "partner in profits" when they have made a pact with the other partners that they will only be accountable for their share of the profits and will not be responsible for any of the losses. However, he is accountable for all of the ways in which the company interacts with third parties. Because partners are jointly and severally liable for debts, he may be required to pay the majority of the obligations if the company sustains significant financial losses and the other partners are unable to pay the bills.

Sub-partner: When one partner in a business decides to share his or her firm's profits with another individual, the latter is referred to as a "sub-partner." Sub partner is completely unrelated to the company's operations. He is not accountable for any of the company's debts and he does not have any rights against the company.

Partner by Estoppel or Holding Out: (Sec. 28): Usually, a person can only become a partner if they agree to do so. But from the outside, someone can also be seen as a partner based on how they act. This happens because of a law called estoppel or holding out. Section 28(1) says that "when a person, by words spoken or written, or by his actions, represents himself or knowingly allows himself to be represented as a partner in a firm, he is liable as a partner in that firm to anyone who has given credit to the firm on the basis of any such representation." People who do this are called "partners by estoppel" or "holding out."

4) “No seller of goods can give to the buyer a better title than he himself has”. Explain this rule. Are there any exceptions to this rule? (10)

Ans) The rule that "no seller of goods can give to the buyer a better title than he himself has" is a fundamental principle of contract law. This rule means that a seller cannot transfer a title to goods that he does not own or has an inferior ownership right to. In other words, the buyer can only acquire the title to the goods that the seller has a legal right to transfer.

The reason for this rule is to protect the interests of the buyer and prevent fraud. The buyer relies on the seller's ownership of the goods, and if the seller has no right to transfer the goods, the buyer can suffer significant financial losses.

For example, if a person buys a car from someone who stole it, the buyer cannot claim ownership of the car because the seller had no legal right to transfer the title to the car. The buyer will lose both the car and the money paid to the seller.

This rule applies to both tangible and intangible goods, including intellectual property. For instance, if a person sells a copyright that he does not own or has an inferior right to, the buyer will not have the right to use that copyright.

There are a few exceptions to this rule, such as:

Sales by Mercantile Agents: A mercantile agent is a person who is authorized to sell goods on behalf of the owner. If the mercantile agent sells goods in the normal course of business, the buyer can acquire a good title even if the mercantile agent does not own the goods. This exception applies only if the buyer is acting in good faith and has no knowledge that the mercantile agent is not the owner of the goods.

Sales by a Person in Possession of Goods: If a person is in possession of goods and sells them, the buyer can acquire a good title if the person has a right to possess the goods. This exception applies if the buyer is acting in good faith and has no knowledge that the person selling the goods has no right to possess them.

Sales Under Voidable Title: If a seller sells goods under a voidable title, the buyer can acquire a good title if the seller has not avoided the contract. For example, if a person sells a car that he had bought on a loan, the buyer can acquire a good title if the seller has not defaulted on the loan and the lender has not taken possession of the car.

Sales in Market Overt: A market overt is a market where goods are sold openly and publicly. If a person buys goods in a market overt, the buyer can acquire a good title even if the seller had no right to transfer the goods.

In conclusion, the rule that "no seller of goods can give to the buyer a better title than he himself has" is a fundamental principle of contract law. It means that a buyer can only acquire the title to the goods that the seller has a legal right to transfer. There are a few exceptions to this rule, such as sales by mercantile agents, sales by a person in possession of goods, sales under voidable title, and sales in market overt. It is essential for both buyers and sellers to be aware of these exceptions and the risks involved in acquiring or selling goods.

5) Discuss the essentials of a contract of bailment and state the rights and duties of a bailee. (10)

Ans) A contract of bailment is a legal agreement between two parties, whereby one party (the bailor) delivers personal property to the other party (the bailee) for a specific purpose, and the bailee agrees to hold and use the property in accordance with the terms of the agreement.

The essentials of a contract of bailment include:

Delivery of Property: There must be a delivery of the property from the bailor to the bailee. The property must be physically transferred to the bailee, and the bailee must have control and possession over the property during the term of the bailment.

Purpose of the Bailment: There must be a specific purpose for the bailment, and the bailee must use the property only for that purpose. For example, a bailment can be created for the storage of goods, transportation of goods, or for the repair of goods.

Return of Property: The bailee must return the property to the bailor at the end of the term of the bailment, or according to the terms of the agreement. The property must be returned in the same condition as it was received, except for normal wear and tear.

Consent of the Parties: The bailment must be created with the consent of both the bailor and the bailee. The parties must be competent to enter into the agreement and must have legal capacity to contract.

The bailee has several rights and duties under a contract of bailment. Some of the key rights and duties of a bailee are:

Duty of Care: The bailee has a duty of care to take reasonable care of the property during the term of the bailment. The bailee must use the property only for the specific purpose for which it was bailed and must take reasonable steps to protect it from damage or loss.

Right to Use the Property: The bailee has the right to use the property for the specific purpose for which it was bailed, subject to any limitations or restrictions in the agreement.

Right to Compensation: The bailee is entitled to compensation for the services rendered if the bailment is for the benefit of the bailor. The amount of compensation must be agreed upon by the parties.

Right to Lien: The bailee has a right to a lien on the property for any charges or expenses incurred in relation to the bailment. The lien gives the bailee the right to retain possession of the property until the charges are paid.

Duty to Return the Property: The bailee must return the property to the bailor at the end of the term of the bailment, or according to the terms of the agreement.

Duty to Account for the Property: The bailee must account for the property and any proceeds generated from the use of the property, if applicable.

Duty to Inform the Bailor: The bailee has a duty to inform the bailor of any defects or problems with the property that may affect its use or value.

Section – B

6) Define the term “proposal”. Discuss the essentials of a valid offer. (6)

Ans) For a contract to be valid, both the offer and the acceptance of the offer must be legal. A proposal is another word for an offer. The words "offer" and "proposal" mean the same thing and can be used interchangeably. Section 2(a) says the following about the word "proposal":

"A person makes a proposal when he or she tells another person what they are willing to do or not do in order to get the other person's agreement to do or not do something."

From the above explanation of the word "offer," you can see that an offer has the following parts.

It must be a way to say that you are ready or willing to do or not do something. So, it could be a "positive" act or a "negative" act. A might offer to sell his book to B for Rs. 50, for instance. Ais making a suggestion to do something, which is to sell his book. It is a good thing that the proposer, A, did. On the other hand, when A says he won't sue B if B pays the remaining Rs. 10,000, this is a negative action because A is offering not to sue.

It must be said to someone else. A person can't make a "proposal" to himself.

It must be done with the goal of getting the other person to agree that the actor should not do something. So, just saying, "I might sell my furniture if you give me a good price," is not a proposal.

The person who makes the offer is called the "offered" or "promisor," and the person who accepts it is called the "offeree." When the person who was offered something accepts it, he is called the "acceptor" or the "promise." For example, Ram offers Prem Rs. 10,000 for his scooter. This is what Ram is offering. He is the one making the offer or promise. Prem, to whom the offer was made, is the offeree. If he agrees to buy the scooter for Rs. 10,000, he is the acceptor or the promisee.

7) Define mistake and explain various types of mistakes. (6)

Ans) A mistake is when you have the wrong idea about something. When a mistake leads to a contract, there is no consent, so the contract is not valid. In a broad sense,

Mistake of law refers to a situation where a party makes a mistake about the legal rules that apply to a particular transaction. Mistake of law can be further classified into two types:

Mistake of Indian Law: This occurs when a party to a contract makes a mistake about the legal rules in India. For example, a party may enter into a contract believing that a certain provision is legally enforceable, when in fact, it is not.

Mistake of Foreign Law: This occurs when a party to a contract makes a mistake about the legal rules in a foreign country. For example, a party may enter into a contract with a foreign company, believing that a certain provision is legally enforceable under the laws of that country, when in fact, it is not.

Mistake of fact, on the other hand, refers to a situation where a party makes a mistake about the facts or circumstances surrounding a particular transaction. Mistake of fact can be further classified into two types:

Bilateral Mistake: This occurs when both parties to a contract make the same mistake about a material fact. For example, both parties may believe that a certain piece of property is free from encumbrances, when in fact, it is subject to a mortgage.

Unilateral Mistake: This occurs when only one party to a contract makes a mistake about a material fact. For example, a party may enter into a contract believing that a certain product is of a certain quality, when in fact, it is not.

8) Describe the rights and liabilities of partners on dissolution of a firm. (6)

Ans) When a partnership firm is dissolved, the rights and liabilities of the partners are determined by the partnership agreement and the provisions of the Indian Partnership Act, 1932. The following are the key rights and liabilities of partners on dissolution of a firm:

Right to Wind Up: On dissolution of the firm, every partner has the right to take part in winding up the business of the firm. The partners can continue the business of the firm to complete pending contracts or to realize the assets of the firm. The partners are entitled to share the profits and losses of the business during the period of winding up.

Liability for Debts: The partners are jointly and severally liable for the debts of the firm incurred before dissolution. This means that each partner is liable to the extent of his share in the firm's assets for the payment of the firm's debts.

Right to Use the Firm's Name: After dissolution, no partner can use the firm's name unless it is for the purpose of winding up the business of the firm. The partners can be held liable for any debts incurred by any partner using the firm's name without the consent of the other partners.

Right to Return of Capital: Each partner is entitled to the return of his capital contribution, subject to the payment of the firm's debts and liabilities.

Right to Share Profits: If there are any profits remaining after the payment of the firm's debts and liabilities, the partners are entitled to share the profits in the proportion agreed upon in the partnership agreement.

Liability for Unauthorized Actions: If a partner takes any unauthorized action after the dissolution of the firm, he may be held liable for any losses resulting from such action.

Right to Indemnity: If a partner has to pay more than his share of the firm's debts and liabilities, he is entitled to be indemnified by the other partners.

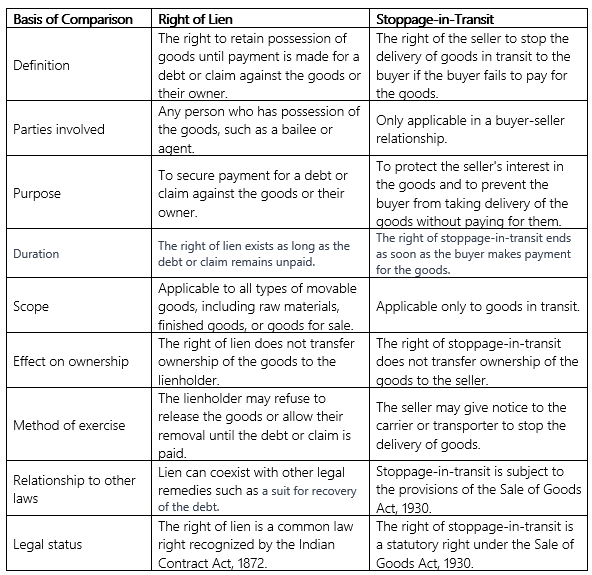

9) Distinguish between the right of lien and stoppage-in-transit. (6)

Ans) The differences between the right of lien and stoppage-in-transit as follows:

10) Discuss the common features among promissory note, bill of exchange and cheque. (6)

Ans) Common features among promissory note, bill of exchange and cheque as follows:

Written Promises: Each of these three instruments contains a written commitment from the person who is issuing the instrument to pay a certain sum of money to the person who is receiving the money (the payee).

Negotiability: Every single one of them is a negotiable document, which implies that ownership can be transferred to another party, or another individual can be made responsible for them by endorsing or delivering the instrument.

Time-bound: Each instrument is time-bound, which means that it has a particular date when it will either be paid off or mature. In contrast to a bill of exchange or a cheque, which can either have a set or determinable date, the maturity date on a promissory note is predetermined.

Legal Enforceability: The terms and conditions of each of the three documents are governed by the applicable legal framework in each of the three different jurisdictions, and all three instruments can be lawfully enforced.

Parties Involved: At a minimum, each instrument requires the participation of two individuals: the issuer and the payee. In the event of a bill of exchange, there may be a third party, such as the drawer or the drawee, depending on the specifics of the transaction.

Payment Mechanism: There is a unique method of payment associated with each instrument. For instance, the issuer of a promissory note is obligated to make a direct payment to the payee on the maturity date of the note, but the payee of a cheque is given permission to take the monies directly from the account of the issuer.

Section – C

11) Distinguish between: (5)

(i) Coercion and undue influence

Ans) Differences between coercion and undue influence as follows:

(ii) Fraud and Misrepresentation

Ans) Differences between Fraud and Misrepresentation as follows:

12) “An agreement in restraint of trade is void”. Examine this statement mentioning exceptions, if any. (5)

Ans) The Indian Contract Act, 1872 states that "every agreement by which anyone is restrained from exercising a lawful profession, trade, or business of any kind is to that extent void". This means that an agreement that seeks to restrict an individual's freedom to carry on a trade, business, or profession is not enforceable in law. This principle is based on the idea that everyone has a right to earn a livelihood by lawful means, and any agreement that restricts this right is against public policy. However, there are a few exceptions to this rule:

Sale of Goodwill: When a person sells the goodwill of a business, they may agree not to carry on a similar business within a specified local limit or time. Such an agreement is valid if it is reasonable in terms of the nature of the business and the local conditions.

Trade Secrets: An agreement that restricts an employee from disclosing trade secrets or confidential information of the employer is valid, as long as it is reasonable in terms of the nature of the business and the information being protected.

Non-compete Agreements: Non-compete agreements are valid if they are reasonable in terms of the duration, geographical area, and scope of the restriction. Such agreements are typically used in employment contracts to prevent employees from competing with their employer for a specified period after leaving the job.

Partnership Agreements: Partners in a business may agree not to carry on a similar business during the term of the partnership. Such an agreement is valid as long as it is reasonable in terms of the nature of the business and the local conditions.

13) What can’t be a partner of a Limited Liability Partnership? (5)

Ans) As per the Limited Liability Partnership Act, 2008, there are certain categories of individuals or entities who cannot be designated as partners in a Limited Liability Partnership (LLP). These include:

Minor Individuals: A person who has not attained the age of 18 years cannot be a partner in an LLP. However, they may be admitted to the benefits of the partnership with the permission of all partners.

Undischarged Insolvent Individuals: A person who has been adjudged as an insolvent and whose insolvency has not been discharged cannot be a partner in an LLP.

Persons Disqualified by Law: Any person who has been convicted of an offense involving fraud or dishonesty cannot be a partner in an LLP unless they have been granted a pardon or the conviction has been reversed or set aside.

Foreign Entities or Individuals: Foreign entities or individuals who are not allowed by law to form an LLP in their home country cannot be partners in an LLP in India.

Companies or LLPs: Companies or LLPs cannot become partners in an LLP, but they can be designated as designated partners.

In addition to the above restrictions, the LLP agreement may also prescribe certain qualifications or disqualifications for partners. For example, the agreement may require that partners have a certain level of education, experience, or expertise in the relevant field. It is important to consult the LLP agreement and relevant laws before designating any individual or entity as a partner in an LLP.

14) Explain the essentials of valid contract of sale. (5)

Ans) A contract of sale is a legal agreement in which one party agrees to transfer ownership of goods or services to another party in exchange for some form of consideration, typically money. For a contract of sale to be considered valid, it must fulfil certain requirements or essentials. Here are the essentials of a valid contract of sale:

Offer and Acceptance: The contract must be made by a valid offer from one party and an unconditional acceptance of that offer by the other party. The offer and acceptance must be communicated between the parties.

Intention to Create Legal Relations: The parties must have an intention to create legal relations, which means that they must intend to be bound by the terms of the contract.

Agreement on Subject Matter: The contract must clearly identify the subject matter of the contract, which may be goods, services, or both.

Consideration: There must be consideration for the contract, which is typically in the form of money or some other form of value that the buyer agrees to give in exchange for the goods or services.

Competence of Parties: Both parties to the contract must be competent to enter into the contract, which means that they must be of legal age, sound mind, and not disqualified by law from entering into a contract.

Free Consent: The parties must have given their free and genuine consent to the contract, which means that they must not have been induced to enter into the contract by fraud, misrepresentation, coercion, undue influence, or mistake.

Lawful Object: The subject matter of the contract must be lawful, which means that it must not be prohibited by law or against public policy.

Certainty of Terms: The terms of the contract must be clear and certain, which means that they must be capable of being understood and enforced by the parties and the court.

100% Verified solved assignments from ₹ 40 written in our own words so that you get the best marks!

Don't have time to write your assignment neatly? Get it written by experts and get free home delivery

Get Guidebooks and Help books to pass your exams easily. Get home delivery or download instantly!

Download IGNOU's official study material combined into a single PDF file absolutely free!

Download latest Assignment Question Papers for free in PDF format at the click of a button!

Download Previous year Question Papers for reference and Exam Preparation for free!